Apps have become a central part of e-commerce and m-commerce go-to-market plans. And for lots of good reasons. Not only do apps now command more than half of connected consumer time, but they also enable brands to deliver a uniquely rich user experience tailor-made to the “always-on” lifestyle. That makes them great potential drivers of app marketing ROI.

But with all this marketing ROI opportunity comes a tremendous challenge – how to launch a successful app that drives a profitable long-term relationship with a customer and drives high in-app purchases. Every element of your app marketing strategy needs to align to that goal.

Massive Competition – Massive Marketing ROI Challenges

There are many challenges to your driving maximum marketing ROI through a shopping experience on mobile. Your app will be competing for attention with a tremendous number of other apps. 2.5M on the Android side and 2.4 million on iOS. Even some of the more niche app stores offer consumers more than 100,000 apps. Standing out in that sort of an environment requires both brand awareness and a compelling brand story.

Game apps often focus a great deal of attention hitting the top of the popularity charts in the App Store and Google Play. By “gaming” the charts, these entertainment apps can go a long way toward sealing their fates as a popular application. The challenge, of course, is that the most well-funded games are using the same tactics as other games to crank their popularity. That can sometimes create a lot of noise without a lot of result.

Online retailers don’t need to crack the Apple and Android top 10 to be successful. What matters in m-commerce apps even more than download popularity is staying power and frequency of use on smartphones and tablets.

eCommerce App Rankings

Retailers do compete to be at the top of m-commerce rankings, like Google Play’s Shopping category, but the number of app downloads is often at least an order of magnitude smaller than for gaming apps. For an m-commerce app to be successful, it needs to get downloaded by a critical mass of customers and then used with a reasonable frequency so it can generate strong revenue per customer with strong customer loyalty.

While most of those apps are not focused on transacting and m-commerce, your offering is still competing with a tremendous number of choices. In fact, according to Nielsen, the average smartphone in the US has more than 90 apps on it, but less than a quarter of those are regularly used. So how do you ensure that your app is regularly used and a strong marketing ROI driver?

There are 1,001 online tutorials on how to get a game into the top ten. But the m-commerce app side of the category is far less well-served regarding tips and advice. That’s what this post is all about.

Without further ado, here are 35 tips for more effectively marketing m-commerce apps to drive maximum marketing ROI.

TIPS 1-6: APP MARKETING PLANNING

1. Codify the App Business Objectives

There is a slang term among digital marketers – GMOOT. It’s short for “give me one of those,” a phrase many have heard when new shiny objects have appeared in the digital space. The most common GMOOOT? When your boss runs into your office with the revelation that a competitor has launched something shiny, and demands that you create the same sort of shiny object immediately.

GMOOT makes people pursue actions that are reactive rather than strategic. That can be a significant hindrance when it comes time to measure the marketing ROI of your app marketing efforts. By codifying a business objective BEFORE you begin working on app marketing plans, you go a long way toward ensuring that GMOOT doesn’t result in a lot of wasted, non strategic effort.

One example here would be if the purpose of your app is primarily as a companion experience versus a transactional one, such as with an airline passenger app. In such a case, it would be important to remind the team of this BEFORE your organization spent a great deal on acquisition under the assumption that those investments would drive profitable ticket sales.

2. Spell Out the Real Value Proposition

You developed your app to be something unique, powerful and different. Before you go any further in crafting your marketing campaign for it, make sure you write down exactly what makes your app so special and different. Here are a few questions that may help you get that process focused:

If you already have an e-commerce site, catalog, retail outlets or another means of buying from you: Identify what is different about the buying experience of your app that helps to ensure that it will grow your business.

Is it all about new buying occasions, or reaching and connecting with the next generation of customers, or a new way to showcase your offerings?

Whatever your app’s value proposition is, that’s a key part of what makes it an asset to your brand and business. Assess the advantages (and disadvantages) that your app offers over competing app experiences. This assessment may help you define what you emphasize in your marketing messages and materials.

3. Distill Your Elevator Pitch

Think succinct, clear, intriguing and inspiring. Something that really sets your brand apart. Boil your story down to its essence. Spend some time here, as this statement will form the backbone of all your future communications.

4. Carefully Research Your Target Audience

Even before work began on your app, your team chose (or should have chosen) a target audience for your app. That’s because understanding both the value the app offers…and to whom that value is most relevant…should have been key drivers in its development.

As you plan your marketing efforts and set your marketing ROI goals, it’s important to align all marketing strategy and tactics to attracting that desirable target audience. It should guide your digital marketing messaging, app store page content, creative, media programs and more. Also, carefully communicate your target to all your media partners so they can plan and optimize quickly and easily.

5. Recognize m-Commerce App Marketing is a Marathon

When people think of app marketing, their minds usually go to the hype tactics that gaming companies use to get their offerings to the top of the App Store and Google Play popularity lists. For an m-commerce app to be successful, it needs to get downloaded by a critical mass of customers AND used with a reasonable frequency to generate strong revenue/marketing ROI per customer. Doing that calls for an entirely different set of strategies and tactics than for game or utility app marketing.

For m-commerce, one needs to focus first on how many quality users you are attracting, versus focusing solely on raw install numbers. That’s because success in m-commerce metrics like revenue and marketing ROI comes from optimizing toward those objectives, not simply maximizing your total installed base.

It’s also important to understand how the app rankings work. Recognizing that rank matters less for m-commerce apps than games, learn more about the inputs that drive app ranking so that you focus your effort in the most productive places.

6. Take a Data-Driven Approach to App Marketing

The vast majority of downloads and usage go to the apps in the top few slots of the rankings. We’ve repeatedly seen in our clients’ metrics and data that one of the big differences between leaders and also-rans is their interest and investment in the entire buyer journey, not just the install. Here are a couple of ways that brands make that investment:

Measurement and Attribution: Make sure you have the data to evaluate your various marketing partners on their ability to drive quality users and engagements for your marketing campaigns. When you and your brand take the time to fully measure marketing — including uncovering rich marketing roi insights, you take an important leap into driving maximum value from the marketing channel.

In-App Engagement: Also ensure that you are tracking all the critical customer actions (“events”) that take place in your apps so you can optimize your customer experience over time and identify customer trends and characteristics that yield better return/marketing ROI.

TIPS 7-9: ADVERTISING AND MARKETING SPEND DECISIONS

7. Right-Size Your Acquisition Spend

You need to balance your marketing investment between acquisition goals and post-install metric KPIs to drive maximum total return on investment.

As recently as a year ago, many of our clients were spending 90-100% of their budgets on acquisition. But that has changed as better measurement and analytics have shown that downloads and installs are only the first steps in a longer customer engagement process. Post-install sales are what really drive marketing ROI.

8. Apportion Your Budget Against 3-4 Critical Tasks

Our marketing analytic data have shown that there are four significant hurdles that brands must clear with each user for them to become a high-value customer:

- Go to the app store and download the app

- Launch and engage with the app

- Make a purchase

- Make subsequent purchases

Not all your customers will require four distinct efforts to convert and become regular buyers, but it can be useful to think about the challenge of establishing a regular customer in the context of these four tasks.

9. Include a Website in Your Planning

Your app needs a web presence beyond its store pages to thrive. If your app is an extension of an online commerce business, create content specifically about your app and develop a destination on your site to feature it. If your business is a standalone app business, invest in an attractive web presence to tell your story and attract new users. And festoon those presences with links to your download pages.

TIPS 10-17: APP STORE IDEAS AND SOCIAL MARKETING

10. Tell Your App Story in Very Human Terms

In your marketing messages, “speak” directly to the prospective downloader and explain why the app can help them/is worth downloading. Avoid silicon speak and focus instead on words and claims that will be most relevant to your target audience. How will the app improve THEIR daily experience?

11. Invest the Time to Deliver Effective App Store Pages

Your app store page is like a shop window – a key driver for purchase/download. Make sure you spend enough time making it as strong as you possibly can. Use Google AdWords tools (make sure you first set the Keyword Tool to Mobile) to identify the most popular search terms in your category. Include exciting and appealing screen shots. And consider video – more and more app developers are creating and including video content in their pages to bring the features and benefits to life.

12. Optimize Your App Store Pages Over Time

As you learn more about customers, what they like, how they use your app, etc., make changes to your download pages to clarify communication and enhance appeal. Make sure, for example, that if you give the app a facelift, that you update your screenshots with the most appealing images possible.

13. Claim and Establish Your Social Media Pages

With the amount of time people spend in environments like Twitter, Facebook and Snapchat, it would be crazy not to create and leverage social accounts specifically for your app. It may make sense to establish these pages long before your launch to begin to build buzz for your offering.

For brick and mortar companies, leverage your pre-existing brand pages to hype the app to your follower/believers.

14. Tap Your Team’s Networks

You’d be amazed at how many people can be reached in social media if everyone on your team gets behind publicizing an app. Ask your team to promote the app on their personal brand presences on Facebook, Twitter, Instagram Snapchat, Pinterest and more!

15. Consider Specialty Store Apps

While Google Play and the Apple App Store are the largest libraries of available apps, it may also make sense to feature the Android version of your app in other specialty app stores if there are ones that are appropriate to your offering. While all iPhone apps must be installed from the App Store, Android allows apps to be downloaded from other locations online. Do some searches for specialty stores that attract your target audience or are relevant to your category.

16. STRONGLY Encourage User Reviews

Use your in-app and CRM experiences to request reviews from users. More and more positive reviews can significantly improve your download rate over time.

Target notifications to your most loyal users at moments when they are likely to be excited about the app and anxious to evangelize.

17. Monitor User Feedback

Customer comments and reviews provide an amazing set of in-market information that can help you refine your message and improve your offering. Make sure you monitor the stores, social media presences and leverage social listening tools to keep abreast of what your users are saying about your app.

TIPS 18-20: LEVERAGING THE PRESS

18. Craft a Great Press Kit and Pitch

Online, print and even television outlets can be very helpful to promote your app if you have a good story to tell. Start by thinking about the kinds of media that are popular with your target. Include both traditional media and popular blogs in this evaluation. Create a press kit containing the core information about your app, and include some great high-resolution screenshots. Provide promo codes so journalists can install and use the app easily. Personalize your pitch to each leading media outlet based on the kinds of stories that they cover.

Where possible, present your app as an extension of a recent story idea or topic that the journalist has covered. Above all, make it easy for them to try and then write about your app.

19. Spread the Word About the Press You Get

When you succeed in driving coverage of your app, use your web presences/social media/etc. to publicize a link to the coverage. Journalists and bloggers live and die by the traffic their stories attract. Make it worth the person’s while to have covered you.

20. Reach Out to App Review Sites for Coverage

The more people that have been exposed to your app and message, the greater your potential audience. The effectiveness of this strategy will ultimately relate to the innovativeness of your app. Many sites are focused primarily on games, though you can find quite a few that cover interesting m-commerce apps, especially those with unique buying experiences.

TIPS 21-25: CHOOSING MEDIA PROGRAMS AND PARTNERS

21. Remember that All Installs are Not the Same

If you think that most people who install an app do so because they wanted the app, you may have another think coming. A substantial portion of app installs is paid for on a CPI (cost per install) basis, meaning that media vendors are incentivized to get as many people to download the offering as they can, regardless of the actual level of interest “in the app itself.”

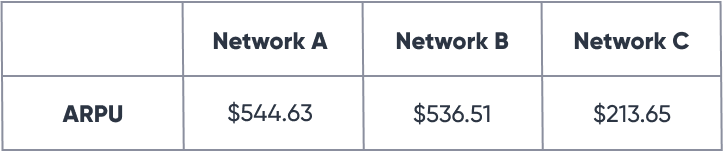

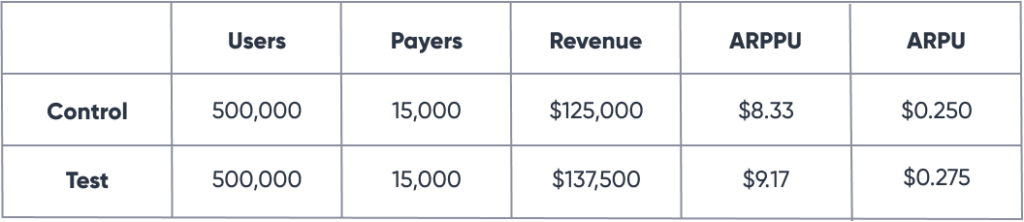

CPI tends to have a very poor correlation with average revenue per user, but strong media vendors can attract great users with that model. It just depends, and that’s why having an attribution platform from the outset of your app launch is so important. By ensuring you have the attribution data from the outset, you can compare your vendors based on their ability to generate revenue, marketing ROI and long-term engagement.

Also, you can work with your winning vendors to improve CPI campaign metrics based upon downstream customer activity.

22. Unlock the Power of Social Media Advertising

Social media consistently proves itself to be highly effective at driving quality customers for e-commerce businesses. Test a variety of paid advertising approaches across the leading social platforms to determine which work well for your brand.

23. Optimize to the Metric that Matters – Marketing ROI

Getting downloads and installs is great, but what’s most important to an e-commerce app is attracting paying customers. While individuals need to download your app to transact on it, download counts alone may not be the best way to compare the results delivered by different media vendors. Instead, focus on their ability to deliver people who transact, or who take actions like putting items into their carts that demonstrate a likelihood to transact in the future.

24. Be Aware of Incentivized Downloads

Incentivized downloads refer to situations where people are rewarded to download an app they may or may not have an interest in. Often, the person is given some virtual good, like gold in a game, in exchange for downloading. As you can imagine, the percentage of people who use an app that they downloaded because of an incentive tends to be rather low, though it varies considerably.

Reputable vendors can deliver great potential customers this way, but this segment of the media business also contains some bottom feeders. Again, the key to using CPI vendors effectively is having data that enables you to understand the value of the installs they bring you.

In short, there are no hard and fast rules about CPI and user quality, only correlations.

25. Insist on 3rd-Party Attribution/Reporting

Third-party reporting reduces or eliminates the likelihood of double-counting of marketing results, thereby saving you time and money. Third-party reporting creates peace of mind among all parties.

There are at least two other benefits here as well.

Third parties usually have extensive sets of existing partnerships with media vendors, so there won’t be a need to install an APK every time you test a new vendor.

The best measurement companies also provide enhanced, enterprise-grade security for your data.

Independent third-party reporting for downloads and re-engagements helps ensure a level playing field for all media vendors and apples-to-apples performance comparisons.

TIPS 26-28: DOWNLOAD, INSTALL AND BUYING EXPERIENCE

26. Make Registration Easy

Most m-commerce apps have a registration process, either when you first install or when the user transacts. Mobile retail tends to lose more people during this process than PC-based retail because data entry is more difficult on a phone. Take proactive steps to make registration and transacting as easy as possible.

Consider registration via Facebook, Twitter and LinkedIn. Then, be sure and offer to remember the person’s details for subsequent transactions. That will reduce friction for future purchases.

27. Create a CRM Program for Your App Users

Don’t overlook any opportunity to communicate with people who download your app. An opt-in email program helps you deliver targeted communications to your install base – messages that can drive them to launch and transact.

28. Deliver Push Notifications

Being able to deliver push communications to apps helps remind the user of why they downloaded the app in the first place and keeps it more top of mind. It also offers the opportunity to deliver important product news to those who might not opt-in for emails.

Custom or personalized push notices can also be a powerful tool to drive individuals to take specific actions. A marketing automation platform can make a tremendous level of personalization possible here.

TIPS 29-35: LEVERAGE VIRAL DISTRIBUTION AND WORD OF MOUTH

29. Bake Virality into Your App Experience

Your customer base can be an outstanding means through which to spread the word about your app on social. Baking in social media features in the experience can dramatically increase the potential audience of your app. Other features like the ability to create and share wish lists and message other users can be incredibly helpful here.

30. Brick and Mortar Retailers: Unlock the Power of Your Real-World Touch Points

Brick and mortar stores have tremendous potential awareness and marketing advantages when it comes to publicizing apps. Consider adding references to your app on receipts, signage, roto circulars, catalogs, website, estore, bags and anywhere else that offers a little real estate for a “download the app” message.

In some organizations, it can be a challenge to unleash these touch points because of logistical issues. But remember how free email platforms Yahoo and

Hotmail brought themselves to preeminence? By appending little “get an account” messages to all the emails emanating from their platforms. Using receipts and the like for driving your app business relies on the same principle.

Remember also that apps can enhance retail experiences, so the benefits can and should go both ways. By incorporating features like store maps, product scanning and an easy way to collect and use coupons, the retail experience can be enhanced.

31. Cross-Promote Your App

If your business already has an app, look at the user base as a natural set of people to attract with your new app. Cross-promotion is free and very powerful.

32. Create a Referral Program

Friends and family of m-commerce app users are more likely than the average person to appreciate the same app. By creating a referral program, you can leverage those networks while rewarding loyalists for evangelism. Just make sure you reward behavior related specifically to a core KPI. For instance, rewarding users for recruiting people who make a purchase versus a referral program that rewards a download/install is far more likely to drive meaningful revenue growth.

33. Leverage Retargeting to Close Sales

As we discussed in the budgeting section, your job is far from over when a customer installs an app. To create long-term customer relationships, you need to constantly think of ways to engage app users and bring them back to your app. Retargeting advertising can be extremely effective here.

It’s also great for incenting lapsed users or converting those with demonstrated product interests.

34 Analyze and Speak Directly to Your High-Value Users to Define

We all know that more personal messages tend to drive better results than mass blasts. That’s why it’s so important for you to collect rich customer purchase information – so that you can deliver precise, personalized messages at the perfect moment to drive maximum sales.

To get this kind of customer insight, you will need to leverage both a robust mobile app measurement solution and a mobile-first data management platform to collect, manage, enhance, segment and export customer audiences and data. Get more information on these topics in the Singular website resources section.

35. Use App Customer Data for Cross-Device Marketing

Apps represent the majority of connected consumer time, but they are by no means the only places people spend their time. By collecting in-app customer data and using it as the foundation for customer profiles in a mobile-first DMP, you can define and export audiences. Your audiences can also provide critical insights for look-alike targeting, which can help you acquire more high-quality customers to your app.

Download The Singular ROI Index to see the world’s first ranking of ad networks by app ROI.